In TOSCA the risk register concept lead to the development of a web based application for SME aimed at achieving the full benefits envisioned. The software provides the possibility to screen all company operations and assets for risks and devise plan to mitigate or prevent the scenarios to ensure the capacity of the company to manage business continuity. IT allows the use of participatory risk analysis of company process and procedures, allowing risks identified and analysed around process mapping to be transferred automatically to the risk register. The final software include also a dashboards for easy top-level visualisation of risk status and full realisation of benefits.

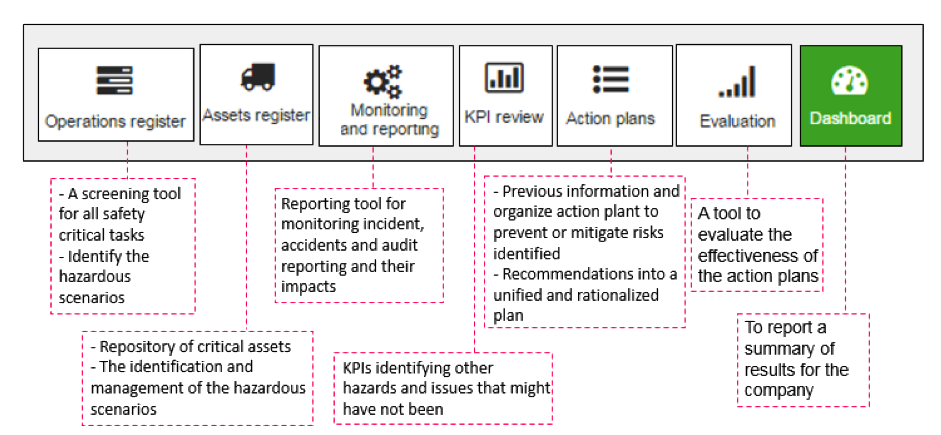

It is composed by different modules that can also be used as stand-alone and as a step by step guide of the building blocks of a complete risk register:

![]() An operations register to be used as a repository and a screening tool for all safety critical tasks in the company and identify the hazardous scenarios related to those.

An operations register to be used as a repository and a screening tool for all safety critical tasks in the company and identify the hazardous scenarios related to those.

![]() An assets register of the company to work as a repository of critical assets and the identification and management of the hazardous scenarios related to those

An assets register of the company to work as a repository of critical assets and the identification and management of the hazardous scenarios related to those

![]() A reporting tool for monitoring incident, accidents and audit reporting and their impacts on companies KPIs identifying other hazards and issues that might have not been covered in the hazard identification performed int eh company on operations and assets

A reporting tool for monitoring incident, accidents and audit reporting and their impacts on companies KPIs identifying other hazards and issues that might have not been covered in the hazard identification performed int eh company on operations and assets

![]() A module to organize and query the previous information and organize action plant to prevent or mitigate the main risks identified aggregating different scenarios and recommendations into a unified and rationalized plan. This will also cover plans to ensure business continuity.

A module to organize and query the previous information and organize action plant to prevent or mitigate the main risks identified aggregating different scenarios and recommendations into a unified and rationalized plan. This will also cover plans to ensure business continuity.

![]() A tool to evaluate the effectiveness of the action plans

A tool to evaluate the effectiveness of the action plans

![]() A dashboard to report a summary of results for the company connected to company risks against relevant KPIs

A dashboard to report a summary of results for the company connected to company risks against relevant KPIs

The benefits by implementing of Risk Register TOSCA:

![]() The ability to compare technical and non-technical risks

The ability to compare technical and non-technical risks

![]() Providing visibility of risks and a quick reference point for targeting investment

Providing visibility of risks and a quick reference point for targeting investment

![]() Aligning risks with internal and external norms

Aligning risks with internal and external norms

![]() And, placing risk management alongside performance management and making it part of management discussions.

And, placing risk management alongside performance management and making it part of management discussions.